I had heard about this from a friend and plan on attending to find out more. Even if you don't live in California you should be worried, as they say what happens in California usually follows in other states.

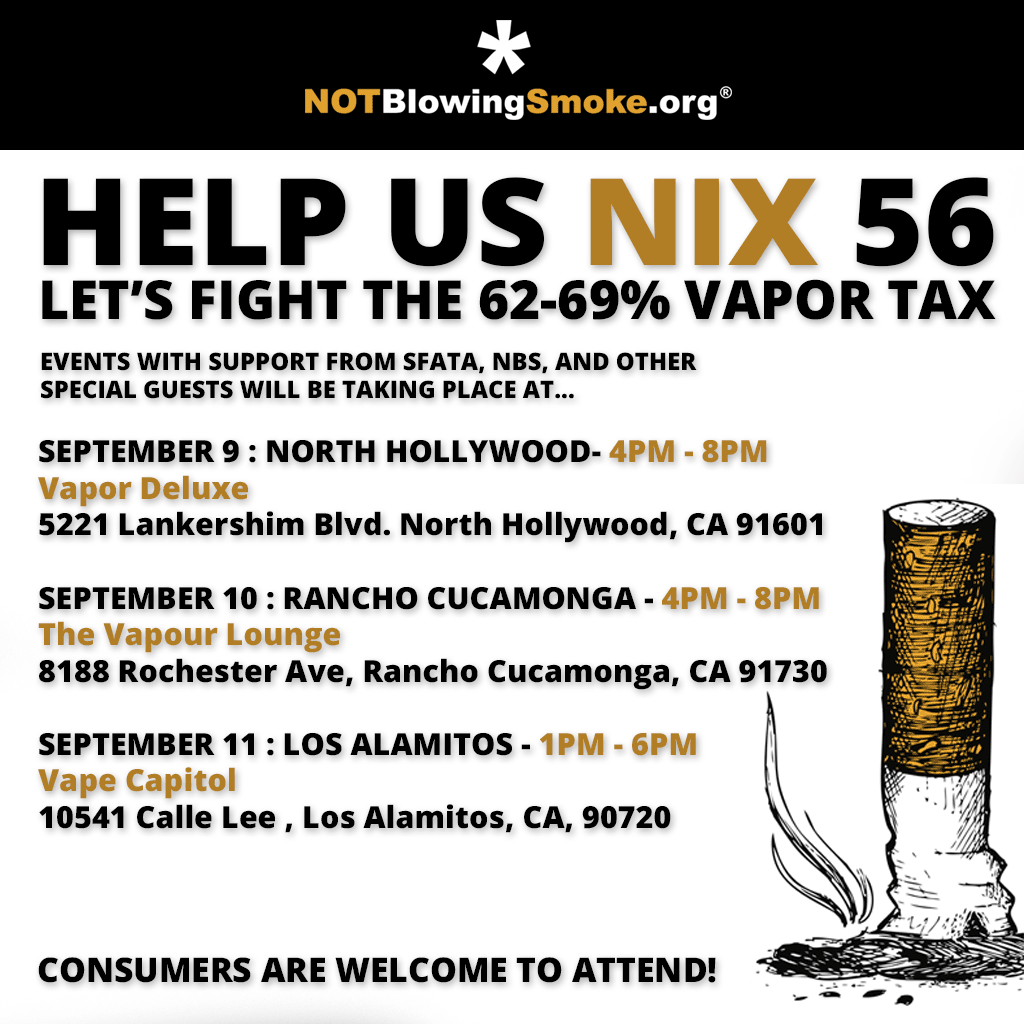

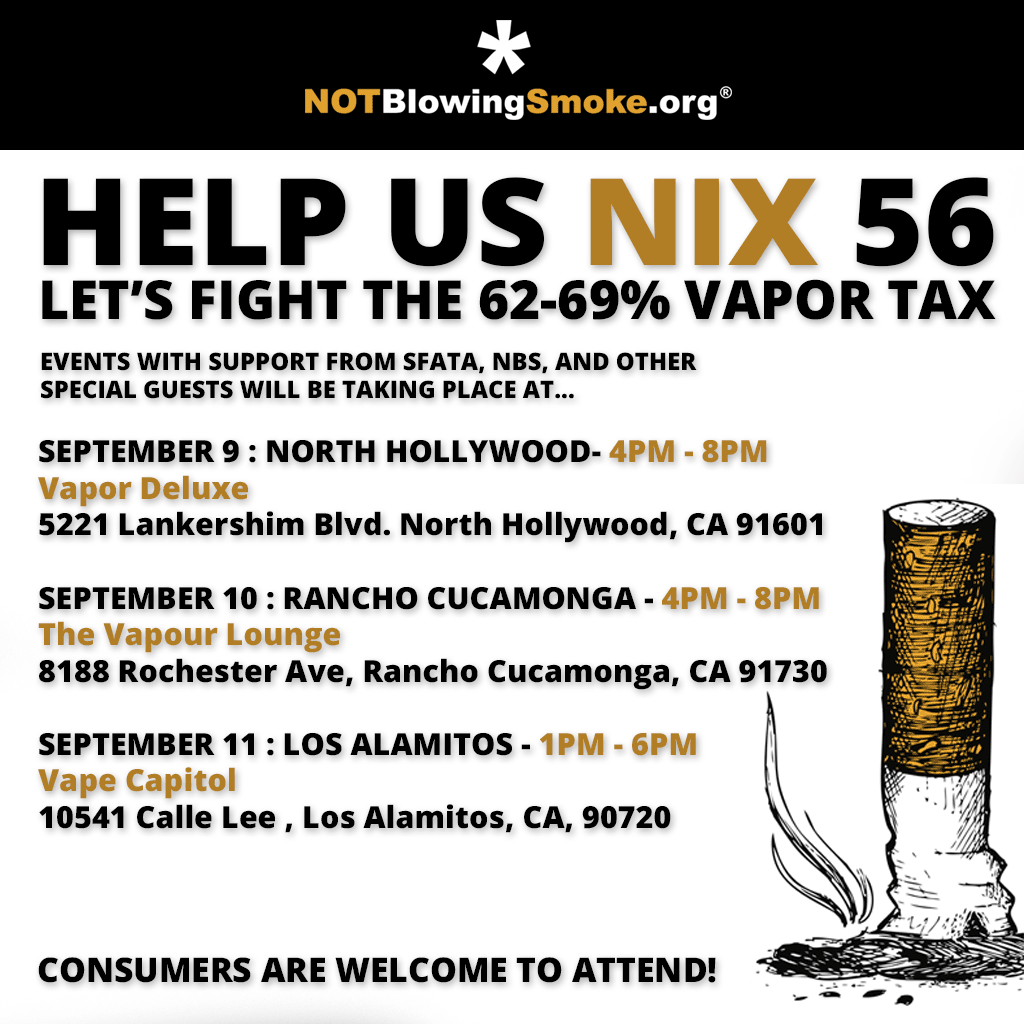

For anyone in S. California there is going to be some get togethers to discuss Prop 56 which is coming up for vote in November, not good news if it passes:

Here is a cut and paste from this reddit thread: https://www.reddit.com/r/electronic...p_56_tax_ballot_measure_industry_meetings_in/

On November 8th, when Californians vote for the next President, you will also vote on Proposition 56, which increases the tax on cigarettes AND vapor products. This could result in a new tax of 62-69% (or more) on vapor products.

This ballot proposition is not what it appears; government and multi-billion dollar pharmaceutical interests lose money as smoking rates decline. This November, they want to make up the difference by taxing vapor products just like cigarettes, at the cost of Californians’ lives.

The supporters of this initiative are very quick to tell you that the money collected from this tax will ONLY be used to fund anti-smoking programs, healthcare, cancer treatment, and research. The only reason they can get away with saying this is because they are betting on the fact that most voters won’t bother to read the actual initiative text. If you do read it, you’ll find that there are plenty of loopholes allowing that money to be used for completely unrelated things. For example, paying $36 million per year to Attorney General Kamala Harris’s own office to use however she likes. But the worst loophole of all is the one that says if this additional tax results in a decrease in tobacco sales (that’s the goal) and that decrease results in a decrease in sales tax and other money the state gets, like MSA payments, (which it will) then the funds can be used to supplement those losses. Which means the majority of this money will go into the general fund. This shouldn’t come as a surprise though. If you look at California’s past uses of smoking-related tax money, (also supposed to be used for smoking prevention) only 4.3% of it actually goes towards smoking prevention activities and education. The rest goes to the general fund. The California government is addicted to tobacco money, and if and when that money goes away, they’ll sacrifice whatever – or whoever – they have to in order to replace it.

ATTEND ONE OF THE MEETINGS IN THE ABOVE LOCATIONS TO LEARN HOW YOU WILL BE IMPACTED AND HOW YOU MAY HAVE A CHANCE IN PREVENTING PROP 56 FROM GAINING A MAJORITY OF YES VOTES.

If you are a resident in California who is allowed to vote but you are not registered to vote, REGISTER TO VOTE NOW! If you are a business in the vapor industry, ask ALL your customers the same thing! There are no excuses and to be perfectly honest the chances of a "vapor vote" making enough of a difference will DEPEND ENTIRELY ON YOU.

For anyone in S. California there is going to be some get togethers to discuss Prop 56 which is coming up for vote in November, not good news if it passes:

Here is a cut and paste from this reddit thread: https://www.reddit.com/r/electronic...p_56_tax_ballot_measure_industry_meetings_in/

On November 8th, when Californians vote for the next President, you will also vote on Proposition 56, which increases the tax on cigarettes AND vapor products. This could result in a new tax of 62-69% (or more) on vapor products.

This ballot proposition is not what it appears; government and multi-billion dollar pharmaceutical interests lose money as smoking rates decline. This November, they want to make up the difference by taxing vapor products just like cigarettes, at the cost of Californians’ lives.

The supporters of this initiative are very quick to tell you that the money collected from this tax will ONLY be used to fund anti-smoking programs, healthcare, cancer treatment, and research. The only reason they can get away with saying this is because they are betting on the fact that most voters won’t bother to read the actual initiative text. If you do read it, you’ll find that there are plenty of loopholes allowing that money to be used for completely unrelated things. For example, paying $36 million per year to Attorney General Kamala Harris’s own office to use however she likes. But the worst loophole of all is the one that says if this additional tax results in a decrease in tobacco sales (that’s the goal) and that decrease results in a decrease in sales tax and other money the state gets, like MSA payments, (which it will) then the funds can be used to supplement those losses. Which means the majority of this money will go into the general fund. This shouldn’t come as a surprise though. If you look at California’s past uses of smoking-related tax money, (also supposed to be used for smoking prevention) only 4.3% of it actually goes towards smoking prevention activities and education. The rest goes to the general fund. The California government is addicted to tobacco money, and if and when that money goes away, they’ll sacrifice whatever – or whoever – they have to in order to replace it.

ATTEND ONE OF THE MEETINGS IN THE ABOVE LOCATIONS TO LEARN HOW YOU WILL BE IMPACTED AND HOW YOU MAY HAVE A CHANCE IN PREVENTING PROP 56 FROM GAINING A MAJORITY OF YES VOTES.

If you are a resident in California who is allowed to vote but you are not registered to vote, REGISTER TO VOTE NOW! If you are a business in the vapor industry, ask ALL your customers the same thing! There are no excuses and to be perfectly honest the chances of a "vapor vote" making enough of a difference will DEPEND ENTIRELY ON YOU.